Introduction to Project English

ACCOUNTING

Accounting is the systematic and comprehensive recording of financial transactions pertaining to a business. Accounting also refers to the process of summarizing, analyzing and reporting these transactions. The financial statements that summarize a large company's operations, financial position and cash flows over a particular period are a concise summary of hundred of thousands of financial transactions it may have entered into over this period. Accounting is one of the key functions for almost any business; it may be handled by a bookkeeper and accountant at small firms or by sizable finance departments with dozens of employees at larger companies.

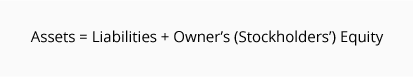

The accounting equation (or basic accounting equation) offers us a simple way to understand how these three amounts relate to each other. The accounting equation for a sole proprietorship is:

- Assets (what it owns): Assets are on the left side of the accounting equation. Asset account balances should be on the left side of the accounts.

- Liabilities (what it owes to others): Liabilities are on the right side of the accounting equation. Liability account balances should be on the right side of the accounts.

- Stockholders' Equity (the difference between assets and liabilities): Stockholders' equity is on the right of the accounting equation. Stockholders' equity account balances should be on the right side of the accounts.

Assets are a company's resources—things the company owns. Examples of assets include cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill. From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner's (or stockholders') equity.

Assets are a company's resources—things the company owns. Examples of assets include cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill. From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner's (or stockholders') equity.

Assets are a company's resources—things the company owns. Examples of assets include cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill. From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner's (or stockholders') equity.

Assets are a company's resources—things the company owns. Examples of assets include cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill. From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner's (or stockholders') equity.

Liabilities are a company's obligations—amounts the company owes. Examples of liabilities include notes or loans payable, accounts payable, salaries and wages payable, interest payable, and income taxes payable (if the company is a regular corporation). Liabilities can be viewed in two ways:

(1) as claims by creditors against the company's assets, and

(2) a source—along with owner or stockholder equity—of the company's assets.

Owner's or stockholders' equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners.

Owner's or stockholders' equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners.